Bookkeeping

Municipal and tax-exempt interest 1040

Content

The U.S. Supreme Court upheld the state tax treatment of municipal bond interest, where the interest on bonds issued by the state and its own localities is exempt, but not the interest on bonds issued by other states and their localities. Interest on federally exempt U.S. obligations- Enter the amount of interest or dividends exempt from federal income tax, but taxable in Virginia, less related expenses. If a taxpayer receives a distribution from a 529A plan for non-qualifying https://quick-bookkeeping.net/ purposes, the distributions may be subject to Pennsylvania personal income tax as interest income. Interest earned from repurchase agreements (“REPOS”) is not tax-exempt interest income; and interest received on obligations, which are only guaranteed by the federal government, is subject to tax. Interest on obligations of other states, territories and their political subdivisions, and instrumentalities is taxable for Pennsylvania personal income tax purposes.

Offering comprehensive tools and expert guidance to companies to help meet regulatory requirements to support sustainability efforts and manage ESG risks efficiently. B. Deduct interest received from Federal securities (for example U.S. Savings Bonds, U.S. Treasury Notes). In general, there are three types of tax-exempt interest. When you use an ATM, in addition to the fee charged by the bank, you may be charged an additional fee by the ATM operator. See your Cardholder Agreement for details on all ATM fees. H&R Block helps you find all the answers about retirement taxes.

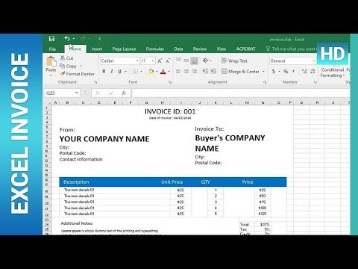

Report tax-exempt interest on Schedule B

Utah is an example of a state that exempts interest on out-of-state bonds, as long as that state does not impose a tax on bonds issued by Utah. Furthermore, capital gains on tax-exempt investments are still taxable; only the interest on these investments is tax-exempt. Janet Berry-Johnson is a CPA with 10 years of experience in public Taxable And Tax Exempt Interest Income accounting and writes about income taxes and small business accounting. Interest on insurance dividends left on deposit with the U.S. Department of Veterans Affairs is nontaxable interest and not reportable. Other interest – Other interest paid to you by a business will be reported to you on Form 1099-INT if it is $600 or more.

Figure the amount of excludable interest on Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989 and show it on Schedule B , Interest and Ordinary Dividends. Refer to Publication 550, Investment Income and Expenses for detailed information. In general, tax-free bonds are likely to be more attractive for taxpayers in higher brackets, since they receive a greater benefit from excluding interest from income. For lower-bracket taxpayers, on the other hand, the tax benefit from excluding interest from income may not be enough to make up for the lower interest rate generally paid on this type of bond.

Burial Fund Earnings

Companies and governments issue bonds to raise money for business operations, expansions or large infrastructure projects. Depending on the taxpayer’s situation, investing in bonds with the higher interest rate may not yield the best result. Wolters Kluwer is a global provider of professional information, software solutions, and services for clinicians, nurses, accountants, lawyers, and tax, finance, audit, risk, compliance, and regulatory sectors. If you’ve received $10 or more in tax-exempt interest, you should receive a 1099-INT or 1099-OID from the payer. Remember, though, that even if you don’t receive one of these forms, you may still need to report the interest.

What is tax exempt interest and dividend income?

Exempt-interest dividend refers to any dividend or part of it that a regulated investment company pays that is not subject to tax. It is designated as such in a written notice that is mailed to the company's shareholders within 45 days after the end of the taxable year.